New functions in Vipps

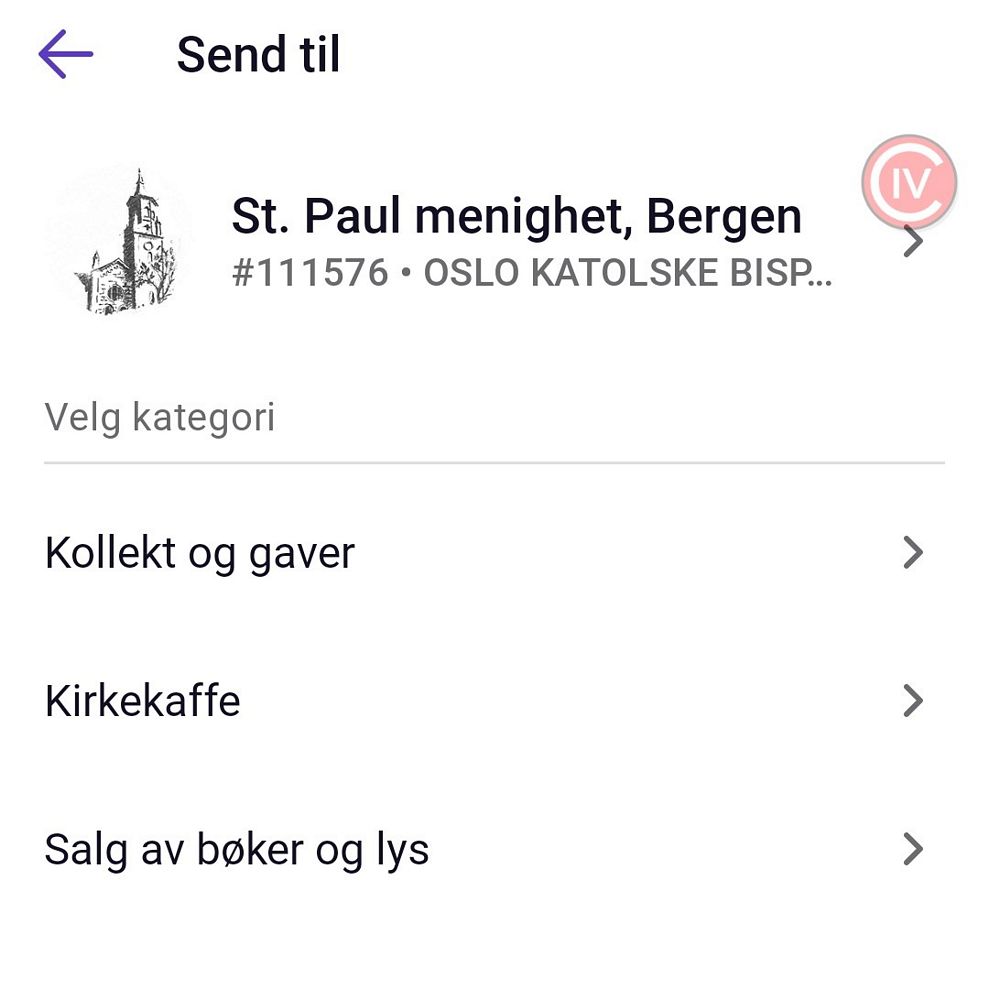

We are adding some new functions to Vipps in our parish (#111576). . This will give us better understanding of receipts in the parish accounts.

We have already made it possible to choose between reasons for the payment. This will give us better understanding of receipts in the parish accounts.

Tax deduction

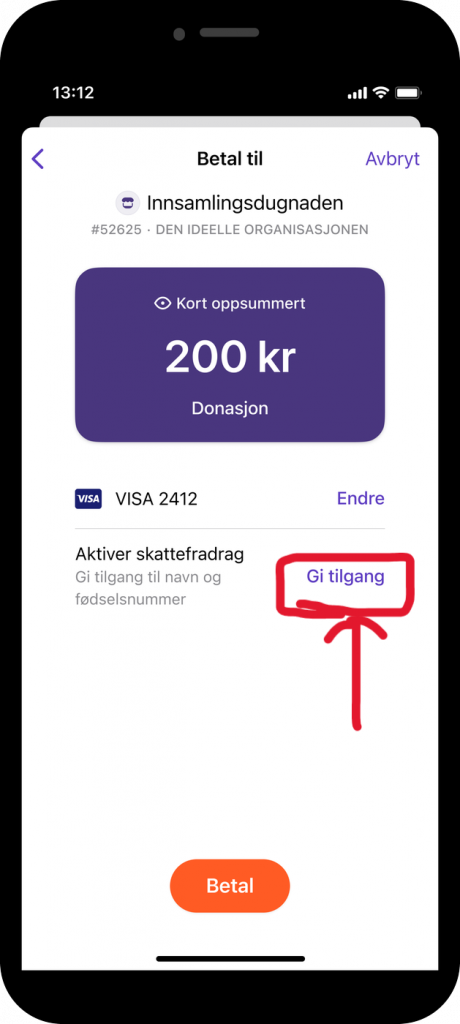

We plan to activate a function very soon in Vipps to make it possible to to receive tax deduction for collection and other donations to the Church made through Vipps. This can be done easily in Vipps:

You pay as usual, but when you have entered the amount, you will be offered the option of enabling tax deduction. If you wish to do this, you should choose “Give access” – Gi tilgang.

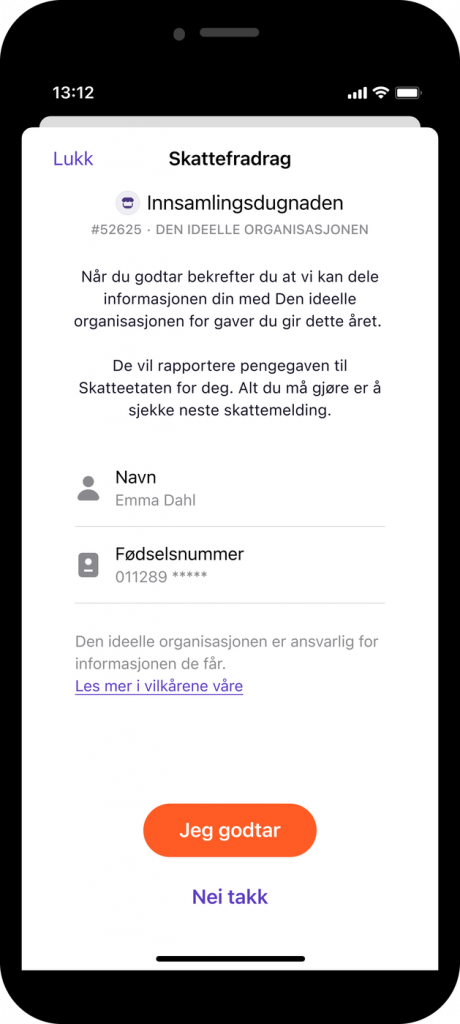

You must next share your name and personal ID number with the parish, so that your donation can be reported correctly to the tax authorities. Choose: “I accept” – Jeg godtar

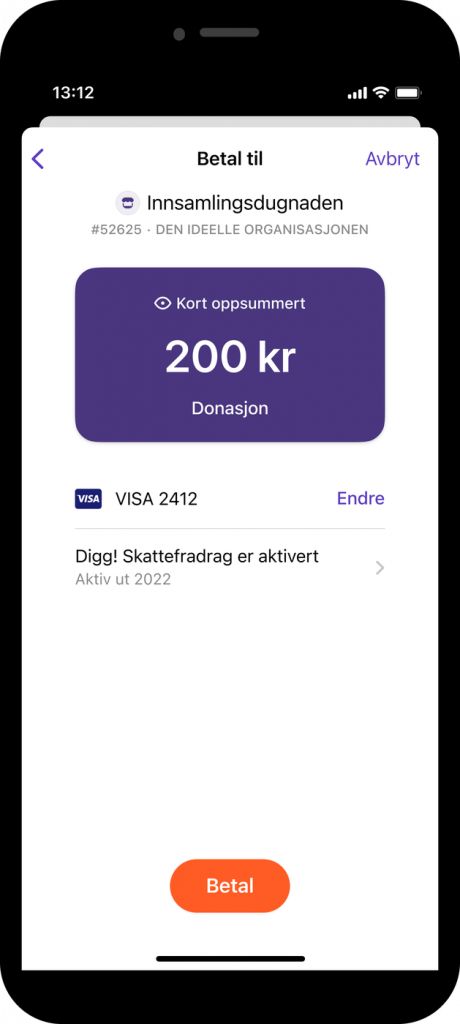

When you have chosen “I accept” you will be returned to the payment page and can complete the operation. Your choice will be remembered for the remainder of the year, so you only need to make this choice the first time.

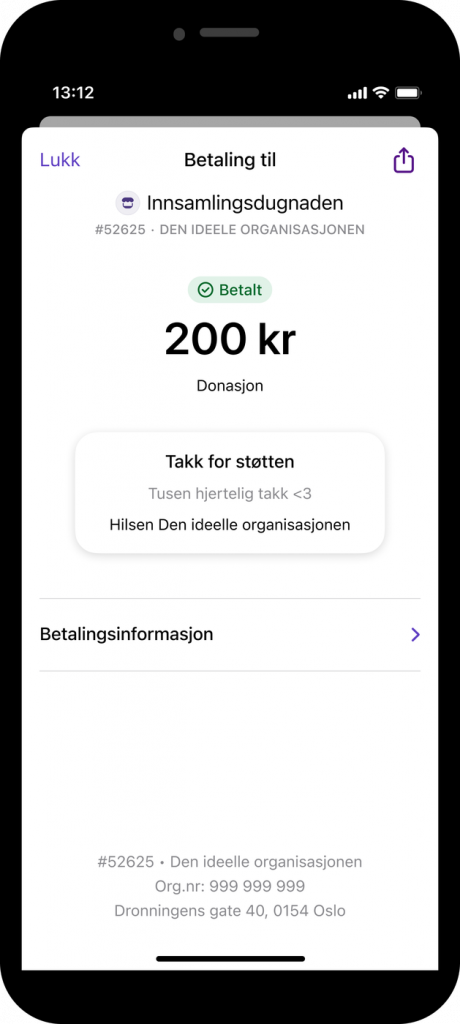

The payment is then completed, and the parish will report your donations at the end of the year.

Thank you for your support

MORE ABOUT TAX DECDUCTION

One can get tax deductions for donations to many organizations. The Catholic Church is one of these. You receive tax deduction for donations if you give more than NOK 500 during a calendar year. The upper limit for donations giving entitlement to tax deduction is NOK 25,000 in 2024. You may of course give more than that, but you will not get deduction fot more than NOK 25,000 in total (the total can be made up of donations to several organizations and entitlement per organization is reached when the sum involved for each is over NOK 500). you may read more here